In an Illinois divorce, any property, money, or debts acquired during the marriage is considered marital property and must be divided between the husband and wife. So however, if you are concerned about keeping certain assets separate or protecting assets from division in divorce, there are a few things to keep in mind.

How Can I Protect My Assets During a Divorce in Chicago, IL?

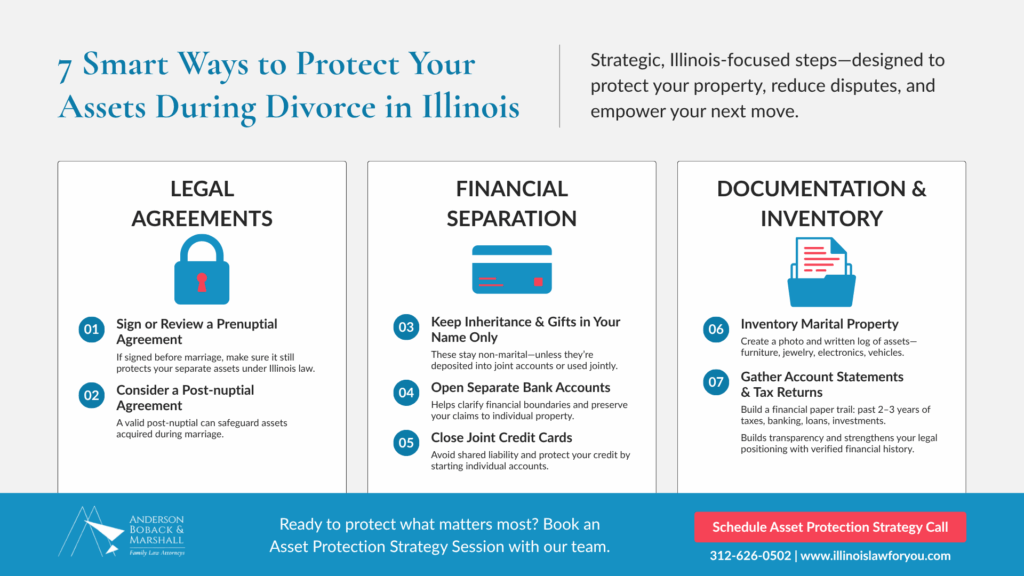

Here are the 3 Ways to Protect Your Assets in a Divorce in Illinois.

1. Protect Your Assets with a Prenuptial Agreement

The first way to ensure specific assets stay separate and protected from becoming part of the marital estate to be divided is to prepare a prenuptial agreement before you get married. A prenuptial agreement signed by you and your fiancé before you get married allows both of you to dictate what property, income, and debts remain your separate property after the marriage and beyond. If there are bank accounts, retirement accounts, or real estate property that were in your sole name before the marriage and you would like to keep it that way, then a prenuptial agreement is the best way to keep them that way. A pre-nuptial agreement can also contain terms about maintenance/spousal support and what that might look like in the event of divorce. Signing a prenuptial agreement can make the divorce process more streamlined and litigation-free if you and your spouse can agree before the marriage.

2. Protecting Assets with a Post-Nuptial Agreement

If you are already married and missed your chance to get a pre-nuptial agreement in place, you may still be in luck. A post-nuptial agreement can also be entered into to be able to keep separate assets separate in the event of a divorce. A post-nuptial agreement is very similar to a pre-nuptial agreement in form and substance but just gets signed after the marriage date. If you and your spouse agree to enter this agreement, you can still ensure that separate accounts and that income and any other property listed in the post-nuptial agreement are kept separate. Your post-nuptial agreement can also include language regarding spousal support or maintenance and what, if anything, might be paid if there is a divorce.

3. Keep Accounts In Your Name Only

If neither a pre-nuptial nor a post-nuptial agreement are in the cards for you, then there are a few other options to protect some of your property in the event of a divorce. Suppose you receive an inheritance during the marriage or even before the marriage, pursuant to Illinois law.

In that case, this inheritance is your separate property and is not able to be divided in a divorce so long as you keep the inheritance funds or property solely in your name. Do not transfer the funds or property into your spouse’s name because then the property becomes marital and cannot be changed back into pre-marital or non-marital property.

If you have any accounts or property from before the marriage that is only in your name, do not change the title or names on the accounts if you want to keep those separate and protected from division. Also, do not put marital funds into these pre-marital accounts.

By keeping your already separate property completely separate from any marital and jointly held accounts, you can protect these assets in a divorce, as they would still be considered your non-marital or pre-marital property.

Related Guide: How to Navigate Messy Issues in High Asset Divorce

How Do You Protect Your Assets During a Divorce?

In general, some other ways to protect your assets during a divorce if you don’t have a pre-nuptial agreement, post-nuptial agreement, inheritance, or separate accounts are the following:

1. Start Separating Bank Accounts

If you only have joint accounts, open an account or accounts in your own name. However, don’t make it a guessing game; let your spouse know you are doing this so you can coordinate payments if monthly expenses and automatic payments were coming out of the joint account. You want to make sure all the bills are paid without putting extra funds in the joint account for your spouse to use.

2. Close Joint Credit Cards

If credit cards are jointly held in your and your spouse’s names, start closing those and splitting the payoff with your spouse. Open cards in your own name, or if you already have credit cards in your own name, start using only those in your name. Doing this makes it so marital debts can be easily determined and allocated, and separate debts can be assigned to the party who incurs them.

3. Take an Inventory of Marital Property

Take pictures of marital property in the house and do an inventory of all items in the marital residence that will need to be divided. To ensure that your spouse does not remove things from the house, take pictures of everything and do an inventory of all assets in the home, garage, and any storage space.

4. Get Statements of All Accounts and Joint Tax Returns

Make sure you get copies of all joint tax returns that were filed so you have this information readily available for your divorce attorney. Also, having statements for all bank accounts, retirement accounts, car loans, credit cards, etc., will allow you to get a big picture of what needs to be allocated between you and your spouse and will help your attorney with negotiations and settlement efforts.

5. Speak to an Experience Divorce Attorney

Make sure to speak to an experienced divorce attorney, like those at Anderson Boback & Marshall for more details on how to protect your assets in a divorce. With trusted legal advice, you’ll be equipped to protect your assets should you end up facing a divorce.