In a high-asset divorce, the stakes are much higher, and costly mistakes can be easily made. Whether it’s improper asset valuation, overlooking tax consequences, or failing to conduct thorough discovery, these errors can cost millions and have long-lasting effects on your financial future. In this article, we’ll cover the 6 most common mistakes in high-asset divorces and provide actionable strategies to avoid them and protect your wealth.

Download our Messy Issues in High Asset Divorce

7 Things to Avoid in Your High Asset Divorce

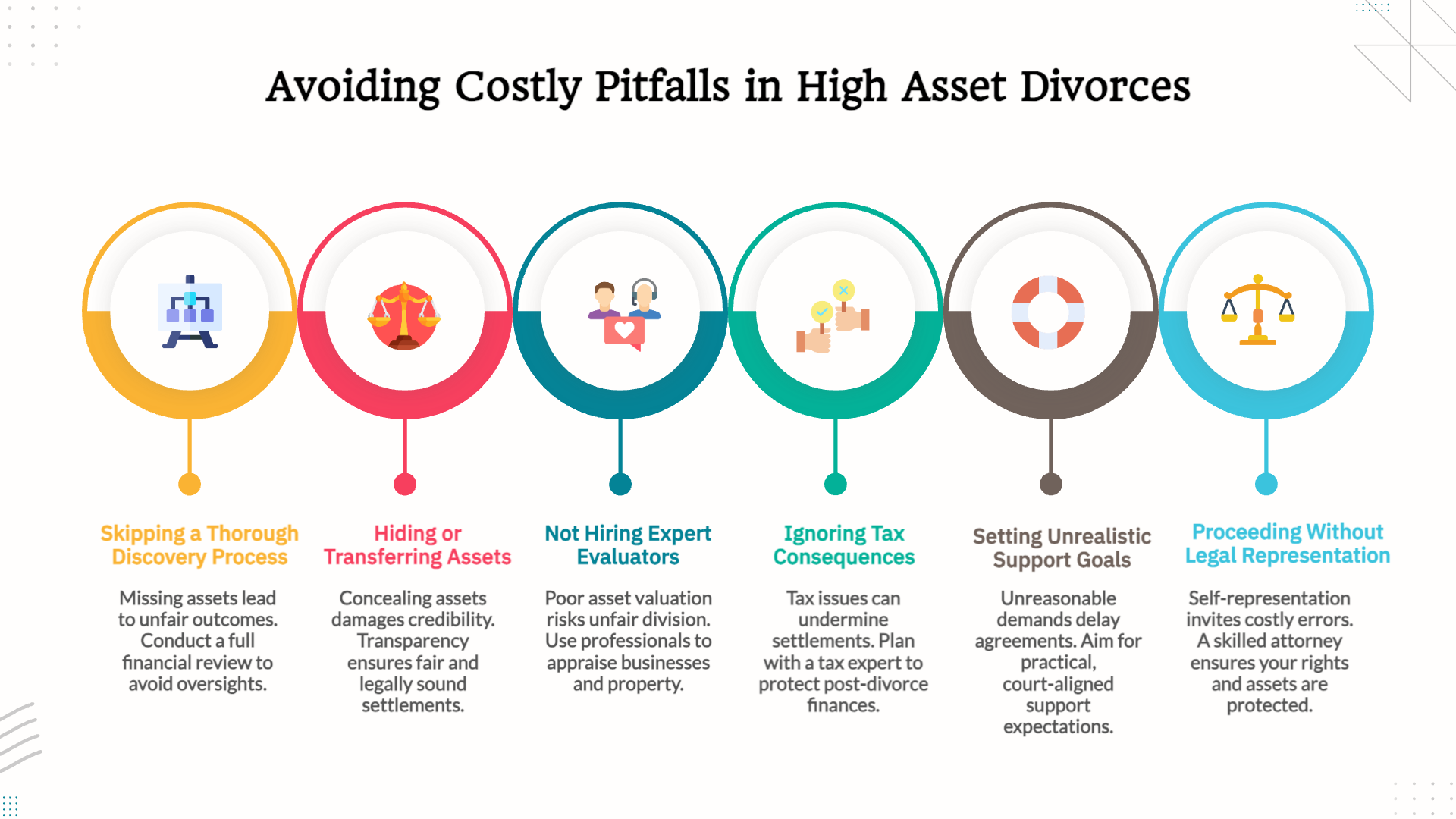

Below is a visual summary of the most common mistakes to avoid in high-asset divorces. Each mistake highlights key issues and the right approach to take for a fair outcome. Do not let yourself fall victim to these common mistakes!

Mistake #1: Not Completing Discovery Thoroughly, Even if the Divorce Is “Amicable”

One of the biggest mistakes in high-asset divorces is not conducting a comprehensive discovery process, even if the divorce seems amicable. High-net-worth divorces may involve complex financial structures, such as offshore accounts, investment properties, and deferred compensation plans. Relying on your spouse’s voluntary disclosures can lead to overlooked or hidden assets, which may drastically reduce your settlement.

Discovery is a formal process designed to uncover all financial details, including bank accounts, investments, and real estate holdings. Waiving discovery makes it nearly impossible to claim a share of undiscovered marital assets later. That’s why it’s crucial to conduct thorough discovery during the initial divorce process.

Working with experts like forensic accountants ensures no asset is missed. Incomplete or skipped discovery can leave you vulnerable to losing millions in assets that could have been part of the settlement.

For a deeper understanding of how discovery works in divorce, read our detailed guide on thediscovery process in divorce, which explains the various methods used to uncover financial details, including document production, interrogatories, and depositions.

Mistake #2: Hiding or Transferring Assets

Hiding or transferring assets during a high-asset divorce can severely backfire. Moving money into offshore accounts, gifting property to relatives, or undervaluing business interests are tactics that often lead to harsh penalties. Courts take dishonesty seriously, and being caught can damage your credibility and result in a larger share of assets going to your spouse.

It may seem tempting to protect your wealth by concealing it, but forensic accountants are skilled at uncovering hidden assets. Once exposed, the court may penalize you, leaving you worse off than if you had been transparent from the start.

Honesty about your finances not only meets legal obligations but is also the best way to ensure a fair settlement. Trying to hide assets often costs far more than it saves.

For more on how hidden assets are uncovered, see our Business Valuation in Divorce guide.

Mistake #3: Not Hiring Proper Evaluators for Large or Unique Assets

In high-asset divorces, failing to hire the right experts to value large or unique assets like real estate, businesses, or luxury items can lead to significant undervaluation. For example, valuing a business requires more than analyzing current income. You need to also consider future earnings, liabilities, and intangible assets like goodwill. Likewise, luxury real estate and collectibles need expert appraisals to reflect their full market value.

Certain business evaluators also specialize in specific industries and types of businesses. Choosing the right evaluator for your particular business is essential.

Without proper evaluations, you may agree to a settlement that undervalues your assets, leaving you with far less than you deserve.

Mistake #4: Ignoring the Tax Implications of Asset Division

Overlooking tax consequences during asset division can be a costly mistake in a high-asset divorce. Different assets, such as real estate, investments, and retirement accounts, come with unique tax liabilities. Selling properties or liquidating investments may trigger capital gains taxes. Dividing retirement accounts improperly can lead to penalties. These tax issues can significantly reduce the actual value of your settlement if you don’t address them.

To make matters more complicated, Illinois divorce attorneys cannot legally provide tax advice.

Consulting a tax expert early in the process ensures you understand these implications. It also helps you make informed decisions. With proper tax planning, you can protect your financial future and avoid unexpected liabilities after the divorce.

Mistake #5: Unrealistic Expectations Regarding Lifestyle and Spousal Support

A common error in high-asset divorces is setting unrealistic expectations about spousal support and post-divorce lifestyle. Courts aim to reach fair outcomes, but requesting support that far exceeds the marital standard often leads to disappointment and prolonged litigation. Being reasonable and pragmatic in spousal support requests is essential, as courts balance fairness with practicality.

A financial planner can help you create a realistic budget for life after divorce. This ensures you’re prepared for any changes in your financial situation.

For more strategies, check out our guide on Navigating Alimony Negotiations in High-Asset Illinois Divorces.

Mistake #6: Not Considering Long-Term Financial Planning

Focusing only on immediate financial concerns during a divorce is a major mistake. In high-asset divorces, you must plan for the long-term impact of your divorce settlement. Post-divorce costs, such as managing complex investments or maintaining luxury properties, can disrupt your financial stability if you ignore them early in the process.

A financial advisor specializing in high-net-worth clients can help structure your settlement to support your long-term goals. Without proper planning, you may face financial strain years after the divorce.

Mistake #7: Divorcing Without an Attorney

In a high-asset divorce, going without an attorney is a serious risk. Even in amicable situations, you might overlook critical legal details and miss out on assets or spousal support you deserve. A divorce attorney experienced with high asset divorces understands the complexities of asset division and future financial planning in high-net-worth cases. They help ensure you receive a fair settlement.

Attorneys also connect you with knowledgeable tax experts who can advise you on the tax implications of your settlement and guide you in making informed decisions.

Final Thoughts About the 7 Mistakes

High-asset divorces are complex and carry significant financial risks. To protect your assets and secure a fair settlement, it’s essential to avoid common mistakes:

• Overlooking asset valuation or critical tax implications that could reduce the value of your settlement.

• Hiring experts who lack the experience to accurately value unique or high-value assets.

• Neglecting long-term financial planning, which can lead to unexpected strain in the future.

If you’re navigating a high-asset divorce in the Chicagoland, IL area, Anderson Boback & Marshall offer the experienced legal representation you need. Our team specializes in guiding clients through the complexities of high-net-worth cases with precision and care. Contact us today to schedule a consultation and protect your financial future.